Categories more

- Adventures (17)

- Arts / Collectables (15)

- Automotive (37)

- Aviation (11)

- Bath, Body, & Health (77)

- Children (6)

- Cigars / Spirits (32)

- Cuisine (16)

- Design/Architecture (22)

- Electronics (13)

- Entertainment (4)

- Event Planning (5)

- Fashion (46)

- Finance (9)

- Gifts / Misc (6)

- Home Decor (45)

- Jewelry (41)

- Pets (3)

- Philanthropy (1)

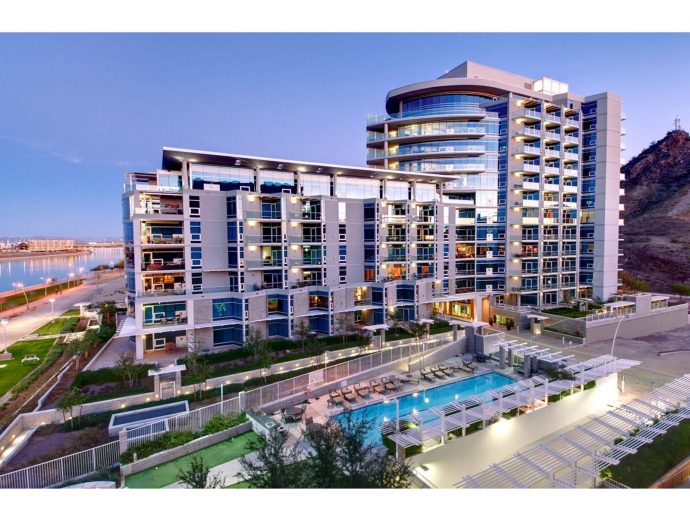

- Real Estate (16)

- Services (23)

- Sports / Golf (14)

- Vacation / Travel (60)

- Watches / Pens (15)

- Wines / Vines (24)

- Yachting / Boating (17)

CEO Douglas Ebenstein of Capital Commercial Properties

Published

02/18/2022If you are talking about high returns, least risk, and great value investments, you should consider investing in a commercial property. We are talking about a million-dollar industry. If you are a very patient person, this investment might be best for you.

Commercial Real Estate refers to the sales or lease of properties only for work-related use. Unlike residential forms of real estate that provide living spaces, it provides office workspace. The buildings are usually on lease to individuals or firms for activities that bring income.

The properties can be a simple storefront or as big as a shopping center. There are four types of CRE (commercial real estate) – Office spaces, family rentals, industrial, and retail.

Investing in CRE requires large investment sums. However, it is a very profitable niche. There are several successful investors in this industry. You may want to search of the Capital Commercial CEO - Doug Ebenstein if you want to know more.

Commercial Real Estate Management and Leasing

As an investor in CRE, you can either be a tenant or a manager. While tenants are those paying for the spaces on lease terms, managers are the owners of the properties. We will discuss what it means to manage or lease a commercial property.

CRE Leasing

80% of buildings occupied by businesses are on lease. The fact is that it costs a lot to put up a standard office structure. Leasing might be best for firms that may not have funds to build a workspace.

The investor(s) who own the place charge a fee. It is called a lease rate. Lease rate is the amount a business pays to a manager for each square foot rented for a period – usually a year. However, there might be other terms of the agreement.

Commercial leasing can be short-term or long-term. Short-term leases can typically be for a year or two. On the other hand, long-term leases can be five to ten years.

There are several payment arrangements. For instance, a manager might require you to pay monthly or yearly installments. Another manager might need a complete payment for the entire leasing period. However, you can go with what is best for your business.

On several occasions, managers will typically calculate the length of the lease in proportion to the space size. For instance, you might have to lease a bigger space for long, than a smaller space.

In addition, several tenants choose to rent spaces for long periods to avoid renting during inflation of prices. Others might rent the larger area for long periods because they might not easily find another one.

We have four types of leases. Each of them requires the tenant or landlord to take responsibility for some aspects. They are gross, single-net, double-net, and triple-net lease

- In gross leasing, the tenants pay only the rent and pass every other fee to the landlord. It might include taxes, insurance, and maintenance.

- In single-net leasing, the tenant pays for the rent in addition to the property taxes.

- In double-net leasing, the tenant pays for the rent in addition to insurance and property taxes

- In triple-net, the tenant pays for the rent in addition to the property taxes, maintenance, and insurance.

CRE Management

There are several skills required to manage a commercial property. As a CRE owner, it might be best to hire a professional or a firm to perform this duty. Their job will include helping you find tenants, manage them, coordinate maintenance, manage financing, and marketability. You can click on https://www.indeed.com/ to read more about becoming a property manager.

Property managers must be competent in some skills. Employing a professional agent or firm for management is best because -they know the building rules governing the area.

Investing In CRE

As we have earlier stated, investing in property is low risk. Unlike the stock markets, the prices of properties are not prone to high volatility. Hence investors can earn large amounts of money in this industry without fear of losses. Though investors make money after selling the property, they get more money from rents.

There are two ways investors can tap into this industry. You can either invest directly or indirectly.

Direct CRE Investment

A direct investment requires the individual or group to become landlords by owning the physical building. It requires good management skills or hiring a professional manager. The investors will need to have some knowledge of the real estate industry.

However, investing as a direct investor requires deep pockets. You will need to pay for the cost of building materials, site engineers, taxes, and other registrations. As an investor, you can stand a chance of making so much money if you are in a region of high CRE demand and low supply.

Indirect CRE Investment

The indirect CRE investment option is for individuals with small investable funds. People can buy the shares of the properties as securities. Therefore, investors can buy in bits and earn money from the proceeds. It is less risky when compared to direct investing, but you make less income here.

Advantages of CRE

Attractive Income

Investors can make so much money on commercial properties. If they are in an area of high demand and low supply, they can cash out big time in this industry. You can generate a steady income from yearly or monthly rents.

Long Contract Period

The longer the rental duration, the higher the chances of maintaining steady cash flow. Managers generally charge higher for properties on lease for long periods. Tenants of commercial buildings usually pay for long periods. Therefore, you can make more money on CRE than residential properties.

Capital Appreciation

Asides from other benefits of CRE, investors will likely enjoy a potential capital appreciation. It only requires them to maintain the properties and keep them up to industry standards. You can click here to read more about capital appreciation.

Disadvantages of CRE

Strict Rules

In this industry, investors face several limitations. You might be discouraged from making an investment decision. In addition, government agencies place several restrictions on commercial buildings. However, you can get through these strict processes with the help of a management team.

High Cost of Investment

Investing in CRE is not a penny business. It requires quite a lot of funds – we are talking millions of dollars. The projects can cost a lot and might require taking loans to complete. However, you can choose to invest in less expensive securities.

Conclusion

Commercial properties refer to all buildings used for official and business purposes. Several businesses do not have a place of their own for working. However, hiring a commercial building can help cut costs.

Investors who have been into this industry have made names for themselves alongside a steady income flow. Investing in CRE might be expensive but, the returns are desirable. You can either invest directly or indirectly. However, you have to ensure that you observe every regulation guiding this investment.