Categories more

- Adventures (17)

- Arts / Collectables (15)

- Automotive (37)

- Aviation (11)

- Bath, Body, & Health (77)

- Children (6)

- Cigars / Spirits (32)

- Cuisine (16)

- Design/Architecture (22)

- Electronics (13)

- Entertainment (4)

- Event Planning (5)

- Fashion (46)

- Finance (9)

- Gifts / Misc (6)

- Home Decor (45)

- Jewelry (41)

- Pets (3)

- Philanthropy (1)

- Real Estate (16)

- Services (23)

- Sports / Golf (14)

- Vacation / Travel (60)

- Watches / Pens (15)

- Wines / Vines (24)

- Yachting / Boating (17)

From Heirloom to Hot Property: Selling Luxury Estates in Probate

Published

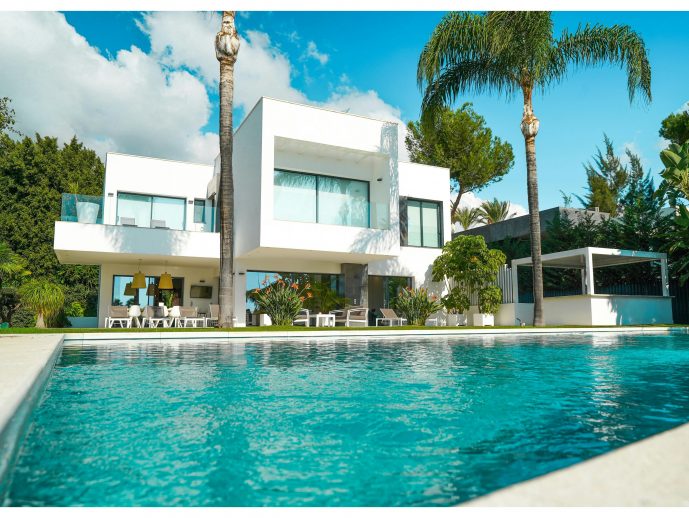

07/16/2025Luxury homes often come with sweeping staircases, imported stonework, and priceless memories—but what happens when these homes become part of a legal process? That’s the story of high-end properties in probate. These estates aren't just listings. They're legacies, often wrapped in both emotional ties and legal red tape.

While a standard home sale has its challenges, dealing with multi-million dollar homes in probate is a different experience altogether. From legal complexities to marketing to the ultra-wealthy, the process demands expertise, timing, and an understanding of both law and luxury. In many cases, hiring a probate realtor becomes essential—not just for a smoother sale, but for preserving the integrity (and value) of the estate itself.

Let’s walk through how these iconic homes shift from inheritance to hot property.

What Makes Probate Sales of Luxury Homes Different?

Luxury properties already sit in a category of their own—custom designs, high-value finishes, sprawling grounds. But when one enters probate, it’s not just the value that’s complex—it’s the process.

Probate is a court-supervised process where a deceased person’s assets are distributed according to their will, or by state law if no will exists. That sounds dry, but when the asset in question is a $5 million waterfront villa or a Manhattan brownstone, things get complicated fast.

Why? Because high-value homes involve more stakeholders, more emotion, and more legal scrutiny. Multiple heirs may disagree about timing or price. There might be unresolved debts or tax complications. Or the property could be in a trust or part of a portfolio with its own stipulations.

These aren’t quick flips. They’re carefully managed transitions.

Legal Readiness Before Listing

Before any “For Sale” sign goes up, the property has to be cleared for sale by the court. This includes:

- Verifying the will (if one exists)

- Appointing an executor or administrator

- Assessing estate debts

- Getting the property professionally appraised

In some states, court confirmation is also required before the sale can proceed. This means even after an offer is accepted, it might still be subject to court approval and overbidding procedures.

The delays can be frustrating—but they’re necessary for legal protection and transparency.

The Valuation Challenge: Price, Emotion, and Legacy

Luxury homes don’t follow cookie-cutter pricing models. Even in strong markets, valuing a high-end estate can be tricky. These properties often include:

- Custom renovations with no clear comparables

- Art collections, wine cellars, or antique finishes

- Iconic architecture that adds intangible value

Heirs may overestimate the home’s worth due to sentimental attachment. Or they may want to offload it quickly without realizing its true potential.

That’s where a seasoned real estate team—appraisers, advisors, and luxury agents—can step in. They bring objective market insights that balance legacy with strategy.

Curb Appeal, Court-Approved

Marketing a luxury home means much more than just a good listing photo. These properties often require:

- Staging that speaks to high-net-worth buyers

- Drone photography and 3D tours

- International exposure across premium platforms

But in probate, every dollar spent on marketing must be justifiable to the court and other heirs. That means aligning every marketing move with fiduciary responsibility.

Sellers need to make a case that spending $10,000 on a staging crew could result in a $200,000 higher closing price—and then document the results. It's a mix of aesthetic savvy and practical accounting.

Who Buys Probate Luxury Homes?

Interestingly, buyers of probate properties often fall into two categories:

- End-users – Wealthy individuals looking for a personal residence, often drawn to the charm, uniqueness, or history of the home.

- Investors or developers – Especially in hot markets like Los Angeles, Miami, or New York, some buyers see an opportunity to purchase under market value and invest in renovations.

Both buyer types expect discretion, efficiency, and clear communication. Probate sales that appear disorganized or overly emotional can turn off serious buyers.

The Importance of Specialized Representation

The luxury and legal sides of a probate sale don’t often overlap—but they must. That’s why specialists with experience in both areas are so valuable. They understand:

- How to deal with luxury buyers

- How to comply with probate court rules

- How to communicate with attorneys, accountants, and multiple heirs

These professionals are often the ones keeping things moving when the emotional or legal weight slows everything down. They can also help protect the estate from liability and ensure full market value is realized.

Time Isn’t Always on Your Side

Luxury homes don’t always sell quickly—even outside probate. Add in court delays, family disputes, or estate debt, and time becomes a real concern.

Every extra month a home sits on the market can mean:

- Additional property taxes

- Ongoing maintenance costs

- Insurance risks (especially for vacant homes)

That’s why it’s essential to prepare early. Even before the home can officially be sold, a proactive approach can keep the process moving—repairs can be started, paperwork gathered, and marketing assets created.

Common Probate Pitfalls with High-End Properties

Even with the best team and strategy, these sales aren’t always smooth. Here are a few frequent issues:

- Disagreements among heirs about whether to keep or sell

- Deferred maintenance that devalues the property

- Clouded title from past loans, liens, or ownership transfers

- Emotional resistance from family members who feel “rushed”

Solutions? Clear communication, early legal review, and transparency with all involved parties. Sometimes that means slowing down. Other times, it means speeding up before the home begins to lose value.

Emotional Intelligence Counts, Too

Selling a high-end home under normal circumstances is emotional. Doing it through probate, after the death of a loved one, adds another layer entirely.

Buyers, sellers, and heirs are all carrying different expectations. A good probate team doesn’t just know how to write contracts or negotiate offers—they know how to read the room.

That empathy helps keep deals together, especially when the process stretches over months or involves multiple families. It also prevents future regrets by making sure everyone feels heard, informed, and fairly treated.

Final Thoughts: Strategy Meets Sensitivity

Luxury probate sales sit at the intersection of emotion, law, and real estate strategy. They’re not just about closing deals—they’re about handling legacy assets with care, clarity, and professionalism.

Whether you're an heir, executor, or buyer, understanding how these homes move through the market can help you make smarter decisions—and avoid the common traps that sink both value and relationships.

In the end, transforming a beloved family home into a sought-after listing takes more than good timing. It takes the right support, smart strategy, and just enough heart to honour what came before while making way for what comes next.