Categories more

- Adventures (17)

- Arts / Collectables (15)

- Automotive (37)

- Aviation (11)

- Bath, Body, & Health (77)

- Children (6)

- Cigars / Spirits (32)

- Cuisine (16)

- Design/Architecture (22)

- Electronics (13)

- Entertainment (4)

- Event Planning (5)

- Fashion (46)

- Finance (9)

- Gifts / Misc (6)

- Home Decor (45)

- Jewelry (41)

- Pets (3)

- Philanthropy (1)

- Real Estate (16)

- Services (23)

- Sports / Golf (14)

- Vacation / Travel (60)

- Watches / Pens (15)

- Wines / Vines (24)

- Yachting / Boating (17)

Published

10/13/2020 by Merilee Kern, MBAAmid escalating demand for alternative investments, expert cites 5 key ways to determine if the historical rare coin asset class ‘fits’ your personal needs and overarching investment goals

With an alarming level of uncertainties across-the-board courtesy of the COVID-19 pandemic, coupled with a return to high market volatility and unprecedented global economic stimulus, investors are increasingly seeking alternative investment strategies. In fact, a recent Chartered Alternative Investment Analyst (CAIA) Association trends and forecast report underscores, among other highlights, how alternative assets classes can help responsible investors reap the long-term benefits of both risk mitigation and return enhancement. So strong the outlook, CAIA Association members expect alternatives to grow to between 18% and 24% of the global investible universe by 2025.

Even so, CAIA does concede that, “as we enter a new decade rife with a global pandemic, the most violent bear market in history and unprecedented uncertainty, alternative investments continue to be a polarizing topic.” This truth is certainly exacerbated by the reality that there are relatively few alternative investment vehicles that are widely regarded as “safe.” The category does offer a diversity of options, from private equity or venture capital, to hedge funds, to real property and commodities.

However, the pandemic has spurred fresh demand for tangible assets like rare coins, which are garnering attention all their own. Rightfully so, as they are regarded as a commodity-like investment where sentimental value may exist, but are also a tangible that can produce attractive financial returns. This as outlined by FinancialPoise.com, which substantiates the many reasons why having coin collectibles as an investment can be a great way to diversify your portfolio and cut down on risk, given it’s an asset class proven to weather storms while also performing with market-like returns.

While the novel coronavirus was sweeping its way across the globe and making financial markets worldwide shudder in its wake, rare coin “prices and participation have risen rapidly since the beginning of the pandemic,” according to Mark Salzberg, Chairman of Numismatic Guaranty Corporation (NGC), in a September report. It further cites that, “The number of sets has risen to more than 175,000, up 40,000 from the beginning of the year,” as well as the fact that the NGC Registry—a free online platform where collectors compete for recognition and awards—has increased its membership base a full 33% in 2020.

In fact, in late March 2020, the Stack’s Bowers auction gained its fair share of publicity for transacting over $26.59 million in U.S. coins, with most on that block earning considerably above their pre-sale estimates determined before the pandemic hit. Coverage of that event indicated several coins ushered in new world records for their type, including the “Little Princess” 1841 quarter eagle in PCGS Proof-64 Cameo from the Pogue Collection, with Eliasberg and Bass collection pedigree that sold for $408,000. Another coin, the 1854-S half eagle that was the first $5 gold coin struck at the San Francisco Mint, sold for $1.92 million after being off the market for nearly four decades.

Of course, the sustained and even escalation in demand for United States rare coin investments is no surprise, as they are historical artifacts that have survived the test of time. Collectors become captivated by why and how they were made, the intrinsic beauty of each and the history and lineage behind—and oft unique to—every piece. The thrill of the hunt to locate these treasures often morphs into healthy obsession, as this emotional driver fuels a great passion among those who dedicate a part of their life to owning these precious historical artifacts. A few prominent collectors from the past few hundred years are known or said to include heads of state such as John Quincy Adams and King Farouk of Egypt; financiers Louis Eliasberg and Harry W. Bass Jr.; real estate developer Brent Pogue; sports team owners Dr. Jerry Buss and Larry H. Miller; and actor Buddy Ebsen, co-founder of the Beverly Hills Coin Club. Even celebrities and star pro sports athletes known to dabble in coin collecting—the so-called "Hobby of Kings”—include Academy Award-winning actress Nicole Kidman, Emmy-winning actor John Larroquette, actor James Earl Jones, NBA all-time leading scorer Kareem Abdul-Jabbar and NHL Hall of Famer Wayne Gretzky.

There are strong driving forces behind the uptick in the global coin market, which is currently estimated at $17.59 billion in revenue annually and growing. This includes the rise in Internet access as well as the popularity of various initiatives, including the United States Mint’s 50 State Quarters Program. With the recent explosion in interest in these historical items, the Smithsonian Institution's National Museum of American History has greatly expanded the space devoted to its numismatic collection and made it a permanent exhibit at the museum.

With this rise in demand and interest also comes questions and concerns, the most paramount of which is determining if including these historical assets in one’s portfolio will help realize overarching investment goals. Below, rare coin investing authority Michael Contursi offers the top five benefit considerations to help wealth-minded individuals decide if this asset class is an apt fit amid—or to commence—their alternative investments holdings.

1. Wealth Preservation

Owning U.S. rare coins has remained a time-tested wealth preservation vehicle. It is as simple as basic supply and demand. These scarce assets have a finite known supply as the United States Mint has kept population records for every coin produced since the birth of the nation. Further, the demand for rare coins has always been high as discerning collectors compete against their peers to own the finest collections. Additionally, since the Great Recession of 2007 to 2009, there has been an exponential increase in the number of global millionaires, a class forecasted to reach 63.9 million individuals by 2024, according to Knight Frank’s “The Wealth Report.” According to its survey of advisors to ultra-high net worth investors, the report further states that nearly one-third of these clients plan to increase their luxury investment allocations. This is anticipated to further increase non-collector global demand for trophies like rare coins, where the asymmetry of low supply and high demand casts a strong positive outlook for further price appreciation.

Beyond the basics of supply and demand, wealthy families that have invested in or collected U.S. rare coins typically have holding power and generally do not need to liquidate their most prized possessions for less than what they paid for them. If your family, for example, owns a rare coin that no one else in the world can own unless you are willing to sell it, you’re positioned to preserve your hard-earned capital and likely realize the level of profit you seek.

- It’s a right FIT if: $100K to $1MM is a small percentage of your overall holdings, and you are in a position to hold these assets for the long-term.

- It’s NOT a right fit if: You cannot afford to hold these assets when you need access to short term cash.

2. Long Term Portfolio Growth

In addition to preserving wealth, U.S. rare coins have demonstrated stability and consistent price appreciation for over 125 years. With the founding of the American Numismatic Association in 1891, as well as public auction records going back several decades, there is a massive amount of third-party public data showing a long track record of performance.

For example, the $4 Stella—produced only from 1879 to 1880—was designed to be used as an international currency to help facilitate trade and travel by U.S. citizens. This proof example from the book titled “100 Greatest U.S. Coins,” authored by Jeff Garrett, has shown steady price appreciation over the last 60 years, where often times these assets remain in a family’s estate and are passed down to heirs for multiple generations.

1880 $4 Gold Stella, Coiled Hair

- 1960: $15,000

- 1980: $100,000

- 2003: $350,000

- 2019: 1,250,000

Based on the demand for luxury assets and their historically strong risk-return profiles, ultra-high net worth investors are allocating to their portfolios 5% collectibles, with rare coins increasing an impressive 175% in asset value over the last 10 years. There are very few global markets showing more than a century of market-like returns. Blue chip paintings come to mind, although the entry point could be $30 million, whereas an entry-level rare coin is generally in the $75,000 to $150,000 range for the finest known items that collectors need.

Those investors with holding power are in a very strong position to profit, as passionate collectors desire to obtain the items that investors own—and wholeheartedly relish—having in their portfolios. Thus, for collectors to locate these items in a private market and then find someone willing to sell is often an extremely difficult challenge.

If a collector is lucky enough to get that far and find a willing seller, availability becomes much more important than price. The reality is, many rare coin owners with no real need or desire to sell reject lucrative buyer offers, preferring to keep these trophies in their estates without any need to sell.

- It’s a right FIT if: You are looking for safe assets that increase in value at a substantially higher rate than lower yielding alternatives.

- It’s NOT a right fit if: You are focused only on high risk, high reward investments with short term holding periods.

3. Owning Real Assets

With more than $8 trillion of monetary rescue programs and unprecedented global economic stimulus, in addition to the Federal Reserve’s recent adoption of an average inflation target, now more than ever investors are seeking real assets that are proven hedges against inflation. Due to increases in both the money supply and demand for a finite supply of U.S. rare coins with intrinsic value, these assets are poised to continue serving as a hedge against inflation.

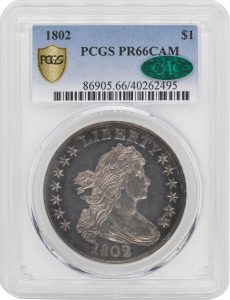

As well, important advances in transparency mean investors no longer need to be an expert, lifelong collector or hold any particular expertise or knowledge base to own these real assets. Global consumer protection organizations like the Professional Coin Grading Service and Numismatic Guaranty Corporation put a financial guarantee on the authenticity and condition level from 0-70 for each coin. This transparency mitigates risk and uncertainty and enhances comfort levels. Anyone can go online and become privy to information like the population known to exist for each coin variety, how many coins are graded higher and even procure price guide values—understanding the finest known coins have very few public sales over the last several decades. Providing yet additional security and peace-of-mind, today’s coins are placed in sonically-welded holders with anti-counterfeit technology and come with a barcode and certification number.

- It’s a right FIT if: You are looking for tangible assets with a very long track record of outpacing inflation.

- It’s NOT a right fit if: You need to personally be an expert in every aspect of your investment holdings.

4. Privacy and Portability

With increased cybersecurity threats on financial accounts, a litigious society looking to put liens on searchable assets and global political instability, high net worth investors are placing a significantly greater premium on privacy. The rare coin market is self-regulated, allowing transactions to remain completely private. This makes the process of buying, owning and selling rare coins very fast, stealth and convenient. Whereas other real assets and collectibles can require significant maintenance or storage costs that eat into net profits, the holding cost for rare coins can be as simple as storing in a small safe deposit box in the jurisdiction of your choice. In addition, owners of these assets can transport large amounts of wealth with extreme ease due to the manageable weight and size of these assets. In fact, many owners use them as a type of insurance policy to retain private wealth outside of the banking system in case of emergency.

- It’s a right FIT if: You are underweight on private and highly portable non-financial assets that can benefit you in case of an emergency.

- It’s NOT a right fit if: You are only comfortable with traditional financial investments or insurance products.

5. Non-Correlated Diversification

U.S. rare coins are not correlated to traditional markets, geopolitics or, thankfully, the 24-hour news cycle. Moreover, these assets are not even tied to the spot price of gold or other commodities, just like a Leonardo da Vinci painting is not correlated to the price of paint. Further, the rare coin market performed well during the Great Recession and continues to do so despite COVID-19—even back in late March 2020 when markets were crumbling prior to global intervention via stimulus.

- It’s a right FIT if: You value non-correlated market-like growth in all market cycles, without the volatility.

- It's NOT a right fit if: You only invest in a few defined portfolio segments and are not seeking broad diversification.

“Any one of the five benefits above are prompting many high net worth investors to add to their existing rare coin holdings, or get started on small portfolios as a way to diversify their real assets or tangible collectibles and, in doing so, enhance their overall risk-return profile,” notes Contursi, President of Rare Coin Wholesalers. This multi-generational family business has been among the most prominent investors in U.S. rare coins for almost half a Century.

As goes without saying, it is imperative to work with a reputable dealer to best assure a purchase is made for the right items at a fair price. Incidentally, there are only a handful of dealers in America who are able to purchase the finest known coins and supply the rest of the market. Such upper-echelon dealers pass that value to investors who can avoid paying a premium to middleman, or worse yet purchase coins that are not recommended holdings. In this realm, transacting in partnership with a well-suited dealer is worth its weight in gold.

Based on Contursi’s top five rare coin investing considerations above, this is an asset class that certainly warrants thoughtful exploration. Rare coins are an exciting way to diversify a real assets allocation while also possessing popular historical artifacts that very few people can ever obtain. Indeed, these “trophy assets” can provide many financial and personal benefits to those fortunate enough to be stewards of these unique pieces of American history.

~~~

Forbes Business Council Member Merilee Kern, MBA is an internationally-regarded brand analyst, strategist and futurist who reports on noteworthy industry change makers, movers, shakers and innovators across all B2B and B2C categories. This includes field experts and thought leaders, brands, products, services, destinations and events. Merilee is Founder, Executive Editor and Producer of “The Luxe List” as well as Host of the nationally-syndicated “Savvy Living” TV show. As a prolific business and consumer trends, lifestyle and leisure industry voice of authority and tastemaker, she keeps her finger on the pulse of the marketplace in search of new and innovative must-haves and exemplary experiences at all price points, from the affordable to the extreme—also delving into the minds behind the brands. Her work reaches multi-millions worldwide via broadcast TV (her own shows and copious others on which she appears) as well as a myriad of print and online publications. Connect with her at www.TheLuxeList.com and www.SavvyLiving.tv / Instagram www.Instagram.com/LuxeListReports / Twitter www.Twitter.com/LuxeListReports / Facebook www.Facebook.com/LuxeListReports / LinkedIN www.LinkedIn.com/in/MerileeKern.

Sources:

https://www.financialpoise.com/investing-in-coins/

https://www.ngccoin.com/news/article/8523/

https://mhojhosresearch.com/2020/05/06/coin-collecting-market-analysis-global-and-europe/

https://www.usmint.gov/learn/coin-and-medal-programs/50-state-quarters

https://americanhistory.si.edu/national-numismatic-collection

https://content.knightfrank.com/content/pdfs/global/the-wealth-report-2020.pdf

https://en.wikipedia.org/wiki/Stella_(United_States_coin)

All photos courtesy/copyright Rare Coin Wholesalers