Categories more

- Adventures (17)

- Arts / Collectables (15)

- Automotive (37)

- Aviation (11)

- Bath, Body, & Health (77)

- Children (6)

- Cigars / Spirits (32)

- Cuisine (16)

- Design/Architecture (22)

- Electronics (13)

- Entertainment (4)

- Event Planning (5)

- Fashion (46)

- Finance (9)

- Gifts / Misc (6)

- Home Decor (45)

- Jewelry (41)

- Pets (3)

- Philanthropy (1)

- Real Estate (16)

- Services (23)

- Sports / Golf (14)

- Vacation / Travel (60)

- Watches / Pens (15)

- Wines / Vines (24)

- Yachting / Boating (17)

What are the easy steps to process the payroll tally? A complete guide to follow:

Published

01/07/2023If you are running an organization, payroll management is essential. The structure of the payroll system depends on the salaries, the number of employees, and prevailing laws and regulations. Apart from this, many factors decide whether the payroll process would be simple or complex. So, creating a system that can work promptly and accurately is essential. But remember to compliance the strategies with regional rules and regulations. Before taking any action, it’s crucial to start from scratch and learn the basic definition first:

What is a payroll process?

Earlier, we discussed that managing payroll is a tedious task, and if the tools need to be corrected, then it becomes more complex. However, if you want to manage it efficiently, then first understand the basic definition:

“Simply put, payroll is money an organization transfers to its employees against their services.”

Every organization has a list of add-ons and deductions that they make from the base pay. There are a few rules that you will have to follow while preparing the payroll process:

- Define the payroll policy, benefits, leaves, and other related items in detail

- Shed light on the components that appear on the paystub according to the company’s policy

- Get the tax details and bank records of all employees

- Calculate the statutory and non-statutory expenses

- Most importantly, record the payroll transactions in the company’s bank account

It is one of the significant and challenging expenses for an organization. But if you manage paystubs manually, the process is more time-consuming, and operating costs increase.

Process payroll in easy steps:

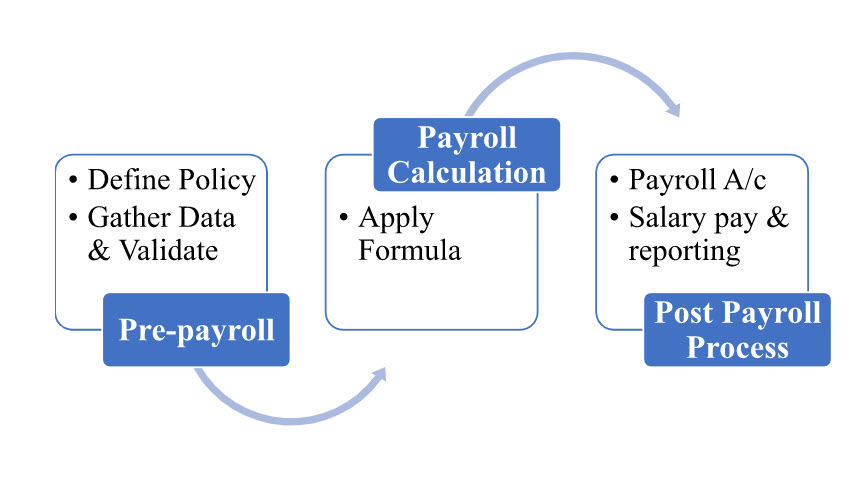

Earlier, we discussed the basic definition of the payroll process and its importance for the organization. Here are the steps that you will have to take to make it more effective:

But if there are gaps in the payroll data flow, you will have to bear the results. So, make the process error-free and in compliance with the rules and laws.

What are the easy steps to process the payroll tally?

There are many unethical business practices, and payroll mismanagement is one of them. We know that faults in the payroll process make it more complicated. Fortunately, the business solutions and accounting software with the name Tally Solutions are saving HR from extra efforts and unnecessary efforts. Also, the adoption of accounting software in Australia has reduced the manual workload for accountants, allowing them to focus on strategic financial planning for their clients. Apart from this, this paystub generator management software offers easy management and directly integrates it with mainstream accounting applications. Here are the following other benefits of these tools:

- You can integrate these with other accounting software

- Helps to generate payroll for employees

- Let you enable payroll processing with laws

- You can even track the loan details of the employees

Moreover, it allows user flexibility, and you can classify data easily into different groups, classes, and components. Besides, it will enable other features like attendance, production time, units, earnings, and deductions of each employee. Here are the following steps if you want to create a payroll tally:

Create employee groups:

The first step is dividing employees into different categories and classes. But the classification should be according to their departments and designations. In this section, you can perform these activities:

- Record the necessary information about employees

- It allows you to configure the setting by pressing F12

- Now you can go to the configure to do the payroll configuration

Besides, at this step, you can initiate other options like showing passport & visa details, contact details, and additional vital information.

Create payroll groups:

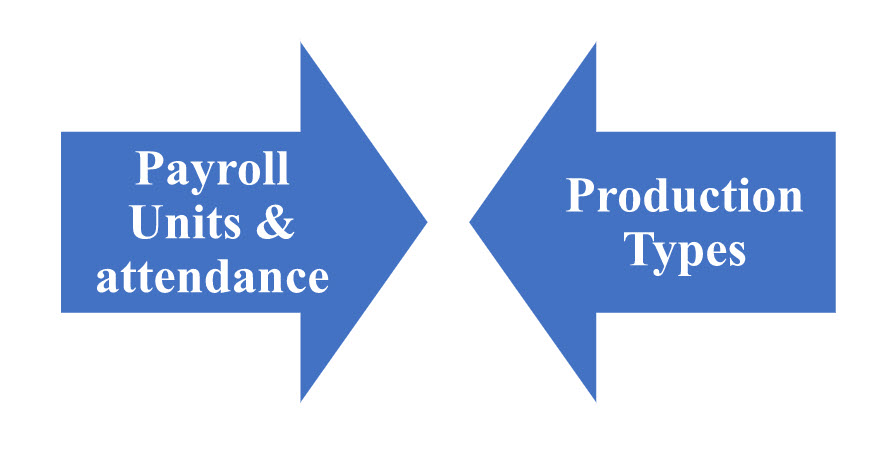

We head towards the second step, where we will create payroll groups. We cover these groups into the following categories:

Apart from this, you can further classify these groups into simple payroll units, individual units (Day, week, month, hours, piece box & numbers), and compound units. In payroll compound units, we make groups of two teams, and pay components are based on single or collective payroll units.

Create different pay heads:

In the third step, you will create different pay heads by considering these elements. The elements include things like:

- Earning

- Deductions

- Employee statutory deductions

- And employer’s contribution

The pay heads are considered earnings and deductions from the employer’s point of view. Apart from this, a few examples of pay heads include basic salary, house rent, dearness allowance, uniform allowance, and sales commission. Examples include provident fund, employee’s state insurance, professional tax, income tax, and TDS and advances.

Create details of the salary:

After creating different pay heads for employees, it’s time to move toward the next step. Yes, the next step is to generate salary details, and we further divide it into these groups:

Group pay structure |

Individual pay structure |

However, after creating these groups, the next step is to process payroll and generate pay stubs. The process is further divided into different stages like the attendance process, payroll process, and payroll reports.

Highlighted features of payroll tally:

Tally offers many payroll processing benefits, and you should give the paystub generator or tally a try at least once. Tally is helping to make the processes more accessible and more straightforward. Don’t miss these highlighted features before making a final purchase:

- The payroll reports are comprehensive and have classifications and subclassifications

- The module is flexible

- It offers the facility to create user-defined earnings and deductions

- It lets us make unlimited groupings of payroll masters

- It provides cost centers and employee-wise costing reports

Moreover, it helps to develop challans and forms for EPF & ESI. Above all, you can use the system to track the loan details of your employees.

Conclusion:

Many businesses carry out the payroll management process manually and in-house, creating many complications. For instance, it can create administrative problems, organizational issues, incompatible software, tracking employee absence, and compliance issues. So, invest in an efficient paystub generator to solve all these problems. A successful business owner knows what to keep and what to outsource.