Categories more

- Adventures (17)

- Arts / Collectables (15)

- Automotive (37)

- Aviation (11)

- Bath, Body, & Health (77)

- Children (6)

- Cigars / Spirits (32)

- Cuisine (16)

- Design/Architecture (22)

- Electronics (13)

- Entertainment (4)

- Event Planning (5)

- Fashion (46)

- Finance (9)

- Gifts / Misc (6)

- Home Decor (45)

- Jewelry (41)

- Pets (3)

- Philanthropy (1)

- Real Estate (16)

- Services (23)

- Sports / Golf (14)

- Vacation / Travel (60)

- Watches / Pens (15)

- Wines / Vines (24)

- Yachting / Boating (17)

Published

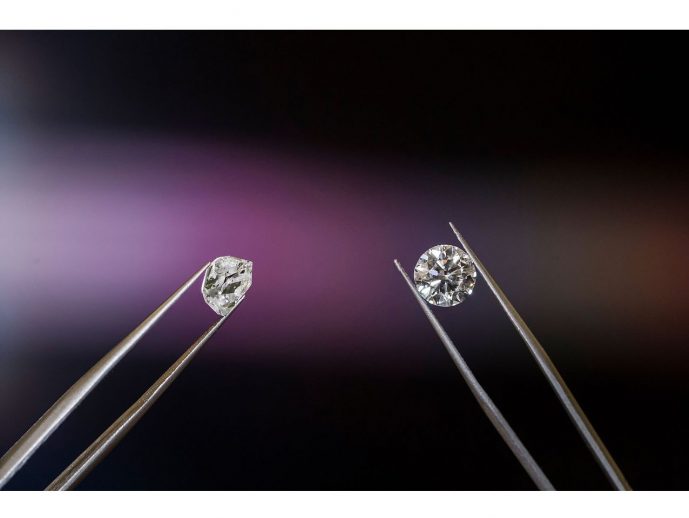

02/16/2023 by FinancialBuzz.comThe global demand for diamonds is on the rise. To illustrate, high demand for diamond jewelry from emerging markets such as China, India, Brazil, and Thailand is driving the global diamond mining market. In addition, and perhaps unexpectedly, rising demand for diamonds for use in industrial applications has also boosted the global market. Diamonds that are not of commercial quality are used in industrial applications, such as grinding wheels for drilling, cutting, polishing applications, electronic chips, and laser components. In recent years, a new way to obtain diamonds has emerged. Lab grown diamonds, which are made in laboratories and factories and are identical to natural diamonds in their composition and appearance. Adamas One Corp. (NASDAQ: JEWL), Signet Jewelers Limited (NYSE: SIG), Rio Tinto Group (NYSE: RIO), Anglo American plc (OTC: NGLOY), Movado Group, Inc. (NYSE: MOV)

According to data published by Allied Market Research, the global lab grown diamonds market size is projected to reach $49.9 billion by 2030, registering a CAGR of 9.4% from 2021 to 2030. The report also indicates that diamonds made in labs are generally of better quality than natural diamonds as they are made in controlled environments with constant monitoring and quality control. Increase in adoption of lab grown diamonds in the fashion and jewelry sector, along with increasing application of these diamonds in the industrial sector have spurred the demand for lab grown diamonds across myriad of industry verticals. In addition, such diamonds can also be customized and personalized as per requirement, which further adds advantages apart from them being highly economical, sustainable, and environment friendly.

Adamas One Corp. (NASDAQ: JEWL) just announced breaking news that, "diamond influencer TRAX NYC conducted a video tour of the Company's Greenville, S.C. factory and posted the Company's development process in a video on Instagram. Within the first hour, the video received more than 200,000 views.

'America is the new Africa when it comes to diamonds and it's all thanks to Adamas One in Greenville, S.C.,' said Maksoud Trax Agadjani, TRAX NYC's founder, who also appeared in the motion picture, Uncut Gems. 'The important thing isn't lab or mined, the important thing is getting a good quality product for a good price … We really appreciate the hospitality and time, we'll make this a worthwhile business endeavor for sure.'

TraxNYC Corp. was founded in 2003. The company's headquarters are located in New York City's famous Diamond District. We are truly sitting at the heart of the global diamond jewelry industry. TraxNYC is committed to enhancing its customer's experience in the selection and appreciation of fine jewelry. Mr. Agadjani is also considered a key social media influence in the diamond industry. Adamas One plans to begin growing custom diamonds for TRAX NYC's business.

"It's amazing to work with creative minds in the diamond industry. Max is so far ahead of the pack in terms of his mindset and marketing, it will be a great partnership for both of our companies. It was great to show off our growing process, which we believe sets us apart from the competition," added Jay Grdina, Adamas One's CEO."

Signet Jewelers Limited (NYSE: SIG) announced on August 9th that it has signed a definitive agreement to acquire Blue Nile, Inc., a leading online retailer of engagement rings and fine jewelry, for $360 million in an all-cash transaction. Blue Nile delivered revenue of more than $500 million in calendar year 2021. The strategic acquisition of Blue Nile accelerates Signet's efforts to expand its bridal offerings and grow its Accessible Luxury portfolio while extending its digital leadership in the jewelry category – all to further enhance shopping experiences for consumers and create value for shareholders. Blue Nile brings an attractive customer demographic that is younger, more affluent, and ethnically diverse which will broaden our customer acquisition funnel. Upon closing, Blue Nile will be strategically positioned at the top tier of Signet's Accessible Luxury banners along with Jared, James Allen and Diamonds Direct.

Rio Tinto Group (NYSE: RIO) produces full spectrum of diamonds in terms of qualities, sizes and colors. The Company's Diavik mine, for example, produces a high proportion of large, white, gem-quality diamonds, traditionally associated with engagement rings, luxury jewelry and collector pieces. The company has partnered with leading international organizations to ensure the integrity and reliability of the wider diamond industry too. We were a founding member and the first mining company to be certified by the Responsible Jewelry Council, which promotes responsible, ethical, social and environmental practices throughout the diamond, gold and platinum jewelry supply chain.

Anglo American plc (OTCQX: NGLOY) announced back in December the value of rough diamond sales (Global Sightholder Sales and Auctions) for De Beers' tenth sales cycle of 2022, amounting to $410 million. Bruce Cleaver, CEO, De Beers Group, said: "Demand for our rough diamonds over the final sales cycle of 2022 was in line with expectations, ahead of the normal seasonal closure of polishing factories in southern Africa over the Christmas period and with Sightholders taking a prudent approach ahead of restocking after Christmas and the expected re-opening of the China market."

Movado Group, Inc. (NYSE: MOV) designs, sources, markets, and distributes watches worldwide. One of the Company's collections powered by Swiss self-winding movements, the 1881 Automatic collection features contemporary designs that reflect the brand's proud Swiss heritage in mechanical timekeeping. Exclusively for women, the elegant new Aria, in white ceramic and stainless steel illuminated by diamonds, redefines sport-chic with brilliant simplicity. The futuristic Sapphire family with its signature flat, edge-to-edge crystal introduces four men's models – two on straps and two on a new, thinner "freefalling" bracelet design.