Categories more

- Adventures (17)

- Arts / Collectables (15)

- Automotive (37)

- Aviation (11)

- Bath, Body, & Health (77)

- Children (6)

- Cigars / Spirits (32)

- Cuisine (16)

- Design/Architecture (22)

- Electronics (13)

- Entertainment (4)

- Event Planning (5)

- Fashion (46)

- Finance (9)

- Gifts / Misc (6)

- Home Decor (45)

- Jewelry (41)

- Pets (3)

- Philanthropy (1)

- Real Estate (16)

- Services (23)

- Sports / Golf (14)

- Vacation / Travel (60)

- Watches / Pens (15)

- Wines / Vines (24)

- Yachting / Boating (17)

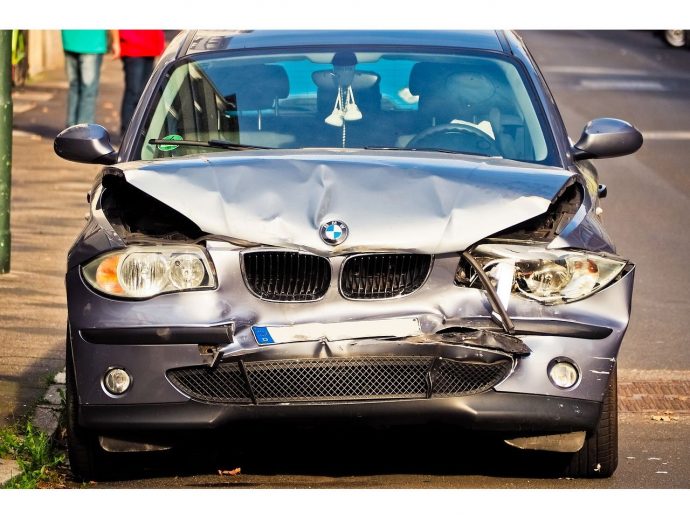

Who Covers Medical Bills and Car Repairs After an Uber or Lyft Accident?

Published

02/16/2025Rideshare accidents create complicated financial and legal questions for those involved. Unlike traditional car accidents, where fault and insurance responsibilities are more straightforward, Uber and Lyft accidents involve multiple layers of coverage. Whether a passenger, driver or third party is injured, different insurance policies may come into play based on when and how the accident occurred. Understanding which policy applies is essential in determining who will cover medical bills and vehicle repairs.

Insurance companies often attempt to minimize payouts, leaving accident victims struggling to recover compensation for medical expenses, lost wages, and car repairs. While Uber and Lyft provide liability coverage for their drivers, disputes over responsibility can delay or reduce claim payments. Knowing how rideshare insurance works, what steps to take after an accident, and when to seek legal guidance can help ensure that victims receive the full compensation they deserve.

Understanding Insurance Coverage in Rideshare Accidents

Rideshare accidents involve unique insurance challenges that differ from standard car crashes. Uber and Lyft provide insurance coverage for drivers, passengers, and third parties, but coverage depends on when the accident occurs. If a driver is waiting for a ride request, actively transporting a passenger, or off duty, different insurance policies may apply. Knowing which policy is responsible helps accident victims determine how medical bills and vehicle repairs will be handled.

In many cases, Uber and Lyft provide liability coverage that covers injuries and property damage when the driver is actively engaged in a ride. However, personal insurance policies may come into play if the driver was off duty. Insurance companies often dispute claims to avoid paying compensation, making it essential for accident victims to understand their rights under rideshare insurance policies.

Medical Bills for Rideshare Passengers

Passengers injured in an Uber or Lyft accident are usually covered under the rideshare company’s insurance policy. When an accident occurs while a driver is transporting a passenger, Uber and Lyft provide up to $1 million in liability coverage. This policy includes coverage for medical expenses, which means injured passengers can seek compensation for hospital bills, surgery, and rehabilitation.

Even with rideshare insurance coverage, victims may need to use their own health insurance initially. Out-of-pocket costs such as deductibles and co-pays may still apply. In cases where medical bills exceed coverage limits, or liability is disputed, seeking legal assistance can help passengers recover the full amount of their medical expenses. Consulting an Uber and Lyft accident attorney can help victims understand their rights and navigate complex insurance claims to ensure they receive the compensation they deserve.

Medical Expenses for Rideshare Drivers

Rideshare drivers injured in an accident may face challenges in getting medical bills covered, especially if they do not carry personal injury protection (PIP) or MedPay coverage. If another driver caused the accident, the at-fault driver’s insurance should cover the medical expenses. However, if the Uber or Lyft driver was responsible, their coverage depends on whether they were actively engaged in a ride.

When a driver is transporting a passenger or on the way to pick one up, Uber and Lyft provide contingent medical coverage through their insurance policies. If the driver was waiting for a ride request, coverage may be limited to their personal auto insurance. Understanding the details of each policy ensures that drivers know how to seek compensation for their injuries.

Who Pays for Car Repairs After a Rideshare Accident?

Vehicle damage after a rideshare accident can lead to costly repairs, leaving both drivers and passengers wondering who is responsible. If another driver caused the accident, their insurance policy should cover repair costs through a property damage liability claim. When an Uber or Lyft driver is at fault, rideshare insurance policies may provide coverage under certain conditions.

Uber and Lyft offer contingent collision coverage, but this only applies if the driver has their own comprehensive or collision insurance. If an accident occurs while waiting for a ride request, the driver’s personal insurance may be responsible. Insurance companies often try to reduce payouts, making it crucial for rideshare drivers to understand their policy limits and coverage eligibility.

What Happens If the At-Fault Driver Has No Insurance?

Accidents involving uninsured or underinsured motorists create additional challenges for victims seeking compensation. Uber and Lyft provide uninsured/underinsured motorist (UM/UIM) coverage when a rideshare driver is engaged in a ride. This coverage helps pay for medical bills and vehicle repairs if the at-fault driver lacks sufficient insurance.

If an accident occurs while a rideshare driver is waiting for a request, UM/UIM coverage may not apply, leaving victims dependent on their own insurance. In these cases, personal injury protection (PIP) or MedPay coverage can help cover medical costs. Consulting an attorney may be necessary if an insurance company refuses to pay fair compensation for damages.

Dealing With Insurance Disputes After a Rideshare Accident

Insurance companies often try to minimize payouts after a rideshare accident, leading to delays or denied claims. Disputes may arise over liability, coverage limits, or policy exclusions, making it difficult for victims to recover medical expenses and car repair costs. When multiple insurance policies apply, determining which one should pay can become complicated.

Keeping detailed records of medical treatments, repair estimates, and communication with insurers can help strengthen a claim. Seeking legal representation can also improve the chances of receiving full compensation. Experienced attorneys understand how to challenge denied claims and negotiate with insurance providers to ensure accident victims are not left covering costs out of pocket.

How to Maximize Compensation After a Rideshare Accident

Securing full compensation after an Uber or Lyft accident requires a proactive approach. Victims should document all medical expenses, vehicle repair estimates, and lost wages to support their claims. Keeping detailed records of doctor visits, physical therapy sessions, and prescription costs helps establish the financial impact of the accident. Additionally, obtaining statements from witnesses and securing dashcam footage can strengthen an insurance or legal claim.

Negotiating with insurance companies can be challenging, as providers often attempt to reduce payouts or deny liability. Seeking legal guidance ensures that accident victims do not settle for less than they deserve. An experienced rideshare accident attorney can help assess all available compensation options, including medical costs, lost income, and pain and suffering damages, maximizing financial recovery.